December 12, 2023

UK Mortgage Broker Guide: Top Tips for the Right Choice

Navigating the UK's mortgage market can be daunting, but with the right broker, it's a smooth sail towards your dream home.

In this article, you'll uncover top tips for finding a mortgage broker who's not just a fit, but a key ally in securing your ideal mortgage.

Whether you're a first-time buyer or looking to remortgage, you'll learn how to spot expertise, dodge pitfalls, and make informed choices.

Understanding Mortgage Brokers

Before you start reaching out to potential brokers, it's crucial to get a grasp on what a mortgage broker is and how they can assist you in your quest for homeownership.

What is a Mortgage Broker?

A mortgage broker acts as a middleman between you and potential lenders. Their primary role is to understand your financial situation and property aspirations, then find and negotiate mortgage deals that best fit your needs.

Unlike loan officers who are employed by lenders, mortgage brokers have access to a wide range of products from various financial institutions and, hence, can offer you more diverse options.

They hold professional expertise in market trends, interest rates, and lending practices, which allows them to identify mortgages you may not find on your own.

By assessing your financial health and discussing your long-term goals, a broker can craft a personalised mortgage strategy.

Benefits of Using a Mortgage Broker

When you're diving into the vast sea of mortgage options, a broker can be your trusted navigator.

Here are some reasons why their services can be invaluable:

Expert Guidance: They provide expert advice tailored to your circumstances, helping you understand the ins and outs of mortgage products.

Time Savings: Brokers do the legwork of searching through products, contacting lenders, and filing paperwork. This means you can save precious time and avoid the hassle that comes with mortgage applications.

Access to Exclusive Deals: Some brokers have access to lender-exclusive deals not available to the general public. This could mean more favourable rates or terms.

Better Success Rates: With their knowledge of lender criteria, mortgage brokers can increase the chances of your application being accepted.

Cost Efficiency: Although brokers may charge fees or receive commissions from lenders, their ability to secure more competitive rates could save you money over the term of your mortgage.

In essence, the role of a mortgage broker is to pave a smoother path to securing a mortgage that aligns with your financial plans.

Their expertise and resources are particularly useful if you're navigating complex situations, such as being self-employed or having a less-than-perfect credit history.

Researching Mortgage Brokers in the UK

When you're on the hunt for a trustworthy mortgage broker, your research will play a crucial role in making an informed decision.

It's not just about landing a stellar mortgage deal; it's also about ensuring that you're partnering with a professional who understands your needs and the complexities of the market.

Let's dive into specific strategies to help you find the best broker for your situation.

1. Ask for Recommendations

Starting with personal recommendations is a smart move. Reach out to friends, family members, or colleagues who've recently purchased property.

Their firsthand experience with a mortgage broker can give you valuable insights that you won't find elsewhere.

Plus, people in your network are likely to give you an honest assessment of their experience.

Network query: Pose questions about service quality and satisfaction

Success stories: Listen for brokers who went the extra mile

Red flags: Keep an eye out for any negative patterns in feedback

2. Check Online Reviews

In today's digital age, online reviews are a goldmine of information. Platforms such as Trustpilot, Google Reviews, and Yelp offer a plethora of customer feedback for you to evaluate.

Look for patterns in the reviews

Consider the volume of reviews—more feedback can indicate reliability

Spot-check for recent reviews to ensure they reflect the current service level

These insights can reveal a lot about a broker's professionalism, response time, and ability to secure advantageous deals.

3. Look for Local or National Mortgage Brokers

You'll find that mortgage brokers operate at both local and national levels. Depending on your needs, one might be more beneficial than the other.

Local brokers may offer a more personal touch and have in-depth knowledge of the local housing market.

On the other hand, national brokers might provide broader services and potentially access more deals.

Local understanding can lead to tailored advice particular to your area

National brokers often have wider access to deals that might not be available locally

4. Consider their Specializations

Mortgage brokers aren't one-size-fits-all. Many have areas of specialization that cater to specific types of mortgages or client situations.

It's important to align your unique needs with their expertise.

First-time buyers might favour brokers experienced in helping new entrants into the housing market

Complex incomes or property types may require a broker with a track record of handling similar scenarios

By focusing on brokers who regularly deal with borrowers like yourself, you increase the chances that they'll be well-equipped to secure the best mortgage for your circumstances.

Keep an eye out for any additional accreditations or qualifications that reinforce their expertise.

Remember, taking the time to research and vet potential mortgage brokers can dramatically improve your home-buying experience. You're not just looking for a good deal—you're looking for a professional partnership that will support one of life's biggest financial decisions.

Evaluating Mortgage Brokers

When you've narrowed down your list of potential mortgage brokers, it’s crucial to evaluate them carefully before making your decision.

The following aspects are key to ensuring that you’re choosing a professional who's not only qualified but also the right fit for your mortgage needs:.

1. Request Proof of Qualifications and Accreditations

Before you entrust a mortgage broker with your home-buying journey, it's essential to verify their professional qualifications. In the UK, any credible mortgage broker should be able to provide evidence of their certifications.

Look out for accreditations from the Financial Conduct Authority (FCA), which regulates the financial services industry in the UK.

Also, ensure they are members of professional bodies such as the National Association of Commercial Finance Brokers (NACFB) or the Association of Mortgage Intermediaries (AMI).

Below are the key qualifications to expect:

Having these qualifications implies they have met industry standards for knowledge and competence in mortgage advice.

2. Inquire About Their Experience and Track Record

The broker’s experience can make a significant difference in navigating the complex mortgage market. An experienced broker likely has dealt with a variety of lending scenarios and can guide you through unexpected challenges.

Ask about their specialities – whether they frequently handle first-time buyers, buy-to-let mortgages, or high-value loans.

Understanding their track record, including the number of successful mortgage applications they’ve handled, can give you insight into their expertise and reliability.

3. Evaluate Their Accessibility and Communication Skills

Accessibility is a critical factor in your relationship with your mortgage broker. You'll want a broker who is readily available to answer your questions and can communicate complex information clearly.

When speaking to potential brokers, pay attention to:

Their response time to your initial enquiry

The clarity and detail of their communication

If they offer flexible meeting times, including evenings or weekends, to suit your schedule

Good communication not only simplifies the process but also ensures that you’re fully informed every step of the way.

4. Compare Costs and Fees

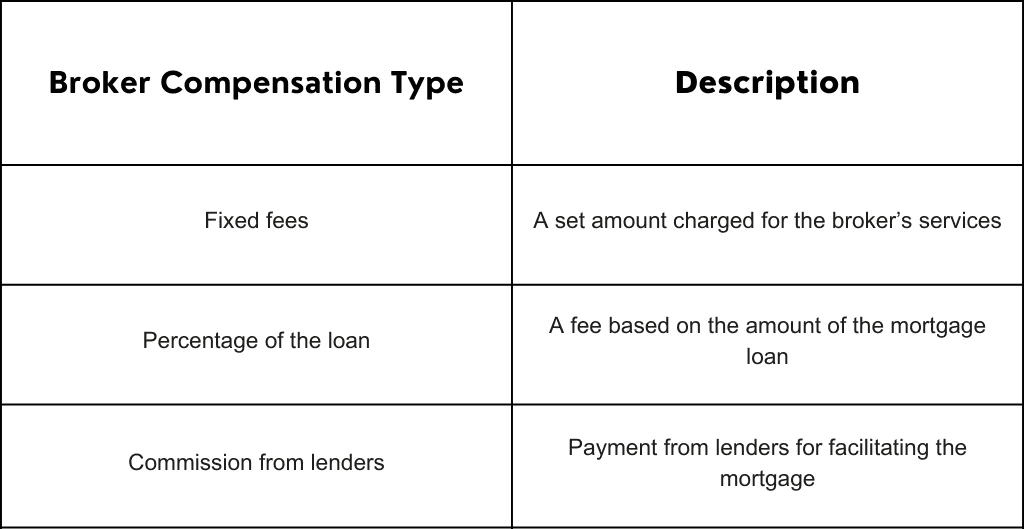

Understanding the financial aspect of engaging with a mortgage broker is essential.

Brokers may charge fees in various ways:

Fixed fees

Percentage of the loan

Commission from lenders

Make sure you're clear on the costs involved and how your broker will be compensated. Compare the fees charged by different brokers for similar services to ensure you’re getting competitive and fair pricing.

This information helps you budget accurately and can be a deciding factor in your final choice.

By thoroughly evaluating potential mortgage brokers on these critical aspects, you’re better positioned to choose one that aligns with your financial goals and values.

Remember to keep your options open, and don’t hesitate to ask probing questions. After all, finding the right mortgage broker could mean a smoother path to acquiring your ideal home.

Meeting with Potential Mortgage Brokers

1. Prepare Questions to Ask

Before meeting with potential mortgage brokers, it's crucial to prepare a list of questions that will help you gauge their expertise and services.

Ask about their qualifications, the range of products they offer, and how they keep up-to-date with current market trends.

You'll also want to inquire about their application process, turnaround times for loan approvals, and any affiliations with lending institutions.

By doing this, you ensure no stone is left unturned.

What are your qualifications and certifications?

How do you stay informed on mortgage trends?

Can you walk me through your loan application process?

2. Discuss Loan Options and Lenders

During your consultation, explore the various loan options and lenders available through the broker. They should provide a broad selection of mortgage products and be willing to explain the pros and cons of each to help you make an informed decision.

It's important they're not biased toward any specific lender but rather focused on finding the best fit for your needs.

Key points to discuss:

The types of mortgage products they offer

Their relationship with lenders and independence

How they determine which loan is most suitable for you

3. Assess their Understanding of your Financial Situation

Your mortgage broker should demonstrate a thorough understanding of your financial circumstances in order to offer tailored advice.

Ensure they consider your income, expenses, and long-term financial goals. Assess their attentiveness to your situation and their ability to ask insightful questions, which will reflect their commitment to finding the best mortgage solution for you.

Areas to evaluate:

Their ability to understand your financial needs

The comprehensiveness of their assessment

Their suggested approach aligns with your financial objectives

Making a Decision

Once you've done your due diligence in researching and interviewing potential mortgage brokers, it's time to move forward in the selection process.

Remember, your choice of broker can significantly impact the success of your mortgage application and the overall deal.

Below are steps that'll guide you as you make your final decision:

1. Review the Mortgage Broker's Proposal

Evaluating the mortgage broker's proposal is a critical step before you commit. The proposal should outline the terms of the potential mortgage, including interest rates, fees, and other essential information about the loan products they recommend.

Ensure every part of the proposal is clear and reflects an understanding of your financial goals.

Key elements to scrutinize in the proposal include:

Interest rates and APR

Type of mortgage – fixed, variable, or tracker

Any fees or charges, including broker fees

Terms and conditions of the mortgage offer

Analyse the long-term implications of the proposal on your finances. It's not just the monthly payments you need to consider but also the total cost over the life of the loan.

If there are multiple options presented, compare them side by side to determine what's most advantageous for you.

2. Seek Clarification on any Doubts or Concerns

If anything in the proposal is unclear or raises red flags, do not hesitate to seek clarification. An expert mortgage broker should be able to explain complex financial jargon in simple terms and give you peace of mind about your choices.

Questions to consider asking might cover:

Details about lender fees or third-party costs

The process for rate locks and how long they last

The implications of any mortgage penalties or early repayment charges

Also, ask about their response time and the process for addressing issues as they arise. You want to ensure you're working with someone who's not just knowledgeable but also responsive and attentive to your needs.

3. Consider Your Gut Feeling

Lastly, don't underestimate the importance of trusting your intuition. Your gut feeling after interacting with the mortgage broker can provide invaluable insights into whether they're the right fit for you.

Consider how the broker makes you feel:

Secure and well-informed

Pressured or uncomfortable

Confident in their abilities and professionalism

Select a broker who respects your views and with whom you can build a strong professional relationship. Their support and guidance will be pivotal as you navigate through the mortgage process.

It is wise to reflect on all aspects of your interactions with potential brokers before making your choice. Their proposal, clarity in communication, and the trust they engender are central to a partnership that could shape your financial future.

Frequently Asked Questions

1. What should I look for in a trustworthy mortgage broker in the UK?

When looking for a trustworthy mortgage broker, consider their qualifications, accreditations, experience, and track record.

Also, assess their communication skills and ensure they understand your financial situation. It's crucial to feel comfortable with their approach and proposals.

2. How can I evaluate a mortgage broker's experience and track record?

Request details of their past work, client testimonials, and success in securing mortgages under circumstances similar to yours.

Years of experience and the complexity of cases they have managed will also provide insight into their track record.

3. Is it better to choose a local or national mortgage broker?

Both local and national brokers have benefits. Local brokers may have in-depth knowledge of the regional market, while national brokers might offer a wider range of loan options.

Your decision should align with your specific needs and preferences.

4. Should I choose a mortgage broker with a specialization?

If your financial circumstances are unique or you require a specific type of mortgage, it's often helpful to work with a broker who specializes in that area.

They'll be more equipped to advise you on the best options and navigate any complexities.

5. How do I verify a mortgage broker's qualifications and accreditations?

You can request to see their professional certifications and accreditations. In the UK, brokers should be authorized by the Financial Conduct Authority (FCA) or be appointed representative of a company that is.

6. What questions should I prepare to ask a potential mortgage broker?

Inquire about their experience with clients similar to you, specific loan products and lenders, the application process, fees, and how they will tailor their service to your needs.

Also, ask about how they handle situations where applications encounter difficulties.

7. How important is communication when working with a mortgage broker?

Effective communication is crucial. Your broker should be easily accessible, willing to answer your questions clearly and keep you updated throughout the mortgage process.

Good communication can ensure a smoother transaction and better outcomes.

8. Should I compare costs and fees among different mortgage brokers?

Yes, it's important to compare costs and fees as they can significantly affect your overall expenses.

Understand their fee structure, any additional costs that may arise, and how they compare to other brokers to ensure you're getting a fair deal.

9. How do I make a final decision on which mortgage broker to choose?

Review their proposal in detail, ensuring that you understand all aspects and feel comfortable with the terms.

Seek clarification on any doubts, and take into account the value of your gut feeling about the broker's trustworthiness and the advice provided.

Conclusion

You've now got the tools to sift through the options and pinpoint the broker who not only meets your needs but exceeds your expectations.

Remember, it's about finding that perfect blend of expertise, trust, and communication. With the right questions in hand and a clear understanding of what to look for, you're ready to make an informed choice.

Trust in your research, lean on the facts, and let your instincts guide you to a partnership that will pave the way to your new home.

It's time to take that final step with confidence, knowing you're well-equipped to select a mortgage broker who will champion your journey to homeownership.

This content is for informational purposes only and should not be construed as financial advice. Please consult a professional advisor for specific financial guidance.

Similar articles

March 26, 2024

Established fact that a reader will be distracted by the way readable content.

March 26, 2024

Established fact that a reader will be distracted by the way readable content.

March 26, 2024

Established fact that a reader will be distracted by the way readable content.